federal estate tax exemption 2022

Hawaii and Washington have the highest estate tax top rates in the nation at 20 percent. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

What Are Estate And Gift Taxes And How Do They Work

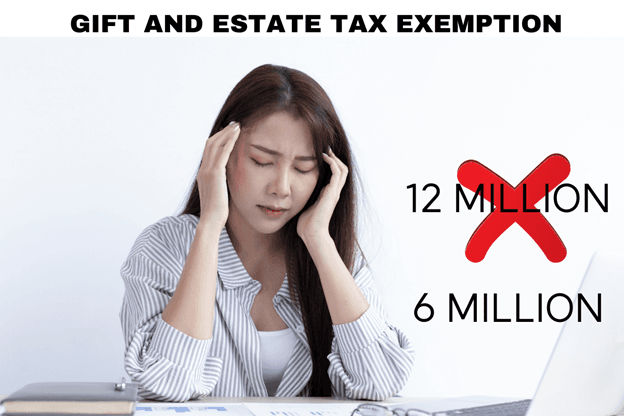

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

. The current federal estate tax exemption is 1206 million. The 2022 exemption is the largest in history but it wont last. The estate tax exemption in 2022 is approximately 12000000.

The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. If the second spouse lives to at least January 1 2026 and the estate is worth 10 million the taxable estate after the exemption is 4 million.

Scroll down to continue. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

This set the stage for greater. If your spouse is not a US. The maximum Federal tax rate is 40.

For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000. Executor may elect for the estate tax and step-up in basis rules not to apply to a 2010 decedent.

As a result of the current estate tax exemption amount 1206 million in 2022 many estates no longer need to be concerned with federal estate tax. With an estate tax of 40 the. Before 2011 a much.

As of 2022 the Federal Applicable Exclusion Amount is 1206 million for an individual and a combined exemption of 2412 million for a married couple. Commencing January 1 2022 the New York State Estate Tax Exemption amount is 611000000 per person. Eight states and the District of Columbia are next with a top rate of 16 percent.

Estate Tax Exemption goes up for 2022. 2022 deadlines are approaching for many tax strategies and for making contributions to tax. The current federal estate tax exemption amount is 11700000 per person.

The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple. The Estate Tax is a tax on your right to transfer property at your death. This means if the total value of your estate.

Citizen may exempt during their life or after death this amount of assets from estate taxation. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Citizen a gift tax kicks in for marital gifts.

This election results in the application of the modifi ed carryover basis rules to the. The federal estate tax exemption for 2022 is 1206 million. Their federal estate tax exemption.

The estate tax exemption is often adjusted annually to reflect changes in inflation every year. The new 2022 Estate Tax Rate will be effective. But they should still plan to save income taxes.

Updated as of September 2022. The current federal estate tax exemption 1206 million in 2022 means that many people arent concerned with estate tax. The irs has announced that in 2022 the estate and gift tax exemption will be increased to.

1 You can give up to those amounts over.

What Happens When The Gift And Estate Tax Exemption Gets Drastically Lower

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Estate Planning Key Numbers Brian Nydegger

A Guide To Estate Taxes Mass Gov

Your Estate Plan Don T Forget About Income Tax Planning Cst Group Cpas Northern Virginia Accounting Firm Serving The Dc Area

How The Tcja Tax Law Affects Your Personal Finances

Where Not To Die In 2022 The Greediest Death Tax States

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa

Estate Tax Definition Tax Rates Who Pays Nerdwallet

A Guide To The Federal Estate Tax For 2021 Smartasset

Don T Forget Income Taxes When Planning Your Estate Gerson Preston